A receipt is a written acknowledgment issued by a seller upon purchasing goods or services. It serves as documented proof for a financial transaction, verifying that payment has been received in exchange for the specified items or services rendered. An invoice is a document issued by a seller to a buyer, requesting payment for goods or services provided. It contains details such as the itemized list of products or services, quantities, prices, and payment terms. In contrast to a receipt, an invoice is sent before the transaction is completed. The more thorough your documentation, the more likely it is that the tax office will class the majority of the expenses as tax deductible.

Create a Free Account and Ask Any Financial Question

This practice ensures accuracy and helps identify any discrepancies or errors in the accounting records. Furthermore, expense reports should always include information about the venue and staff.Additional information is required for hospitality expenses of over $150. For example, to claim transport expenses such as railway tickets and tax fares, you must provide information about your destination. If you were unable to obtain a receipt for these, you can also provide your own documents.

Why You Can Trust Finance Strategists

- In contrast to a receipt, an invoice is sent before the transaction is completed.

- However, it is relatively common to verify small amounts of change using reissued receipts – for example, tips, postage, parking fees, etc.

- All of our content is based on objective analysis, and the opinions are our own.

- Transaction receipts are any receipts that indicate an exchange of money for merchandise was made.

With the rise of modern business practices, standardized receipt formats emerged, typically including details like the seller’s information, purchased items, and transaction amount. Many businesses, such as theaters, use the term when referring to money received during a specific period. If I say “The theater’s receipts for the summer were 10% up on last year,” it means income was 10% higher.

Company

Whenever you start a trip, Shoeboxed tracks your location and miles and saves your route as you drive. Shoeboxed integrates with 12+ apps to automate the tedious tasks of life, including QuickBooks, Xero, and Wave Accounting. Shoeboxed has been voted as the best receipt scanner app for tax season by Hubspot and given the Trusted Vendor and Quality Choice awards by Crozdesk. There are endless ways that receipts can be used, but in this section, we’ll be covering the receipts that are the most inquired about. The term „owner’s equity“ covers the stake belonging to the owner(s) of a privately held company.

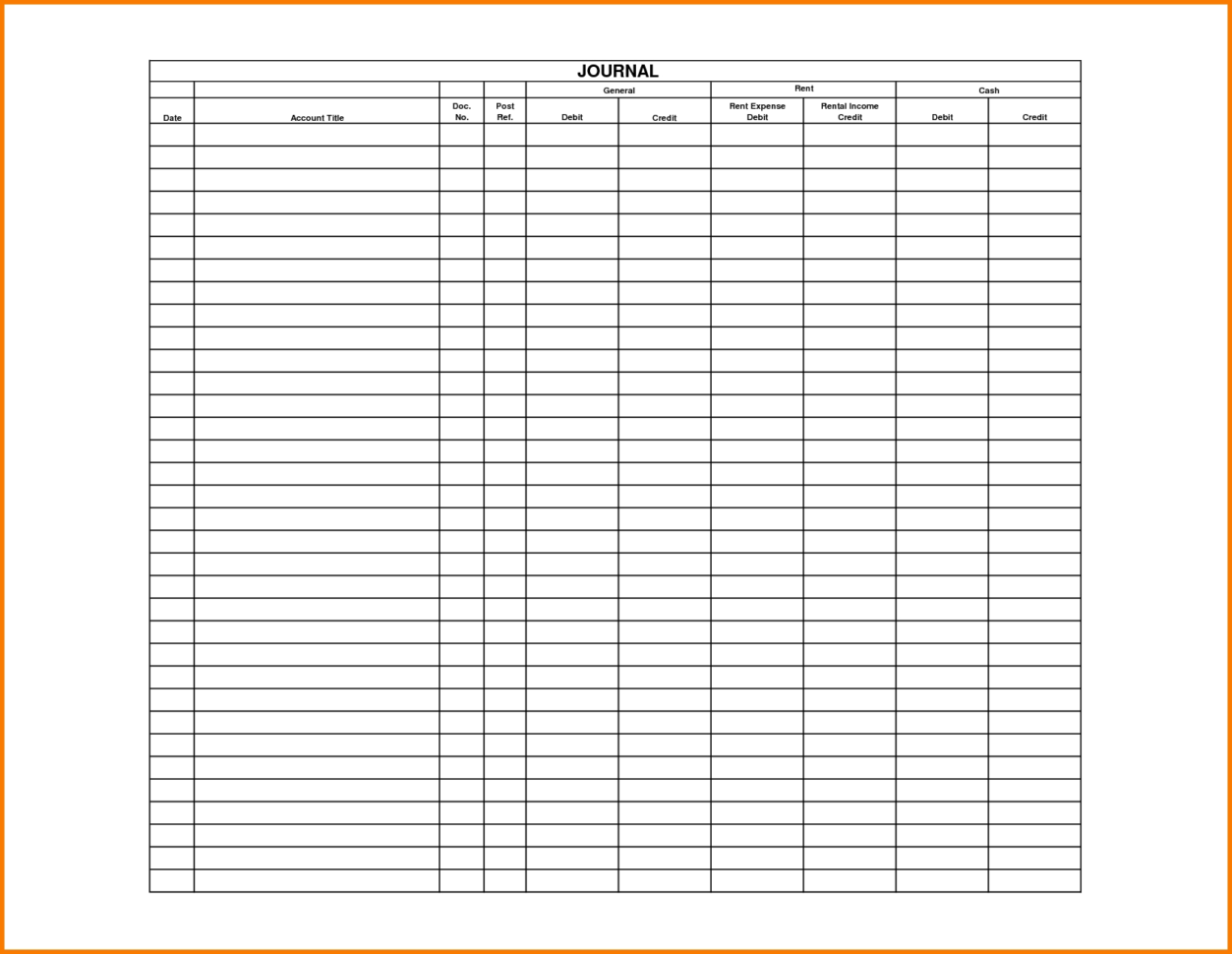

Lastly, it provides readily available data for preparing an income and expenditure account. A receipts and payments account is a summary of actual cash receipts and payments extracted from the cash book over a certain period. All cash received and paid during the period, whether capital or revenue, is included in this account. Receipts are entered on the debit side of the receipts and payments account. The account contains a record of receipts and payments for both capital and revenue.

Purchases are categorized under a tax category for effortless expense management and tax preparation. Importing receipts to your Shoeboxed account is as easy as syncing your Gmail with Shoeboxed, receipt in accounting using Shoeboxed’s special Gmail Receipt Sync feature. While they were commonly used in the hundred-year span of 1870 to 1980, carbon copy receipts are a rare sight in the modern world.

Its primary purpose is to indicate the amount owed by the buyer to the seller. Businesses often use receipts for inventory management and tax calculations, such as payroll or corporate income taxes. Customers may use them for accounting purposes or if they need to be reimbursed.

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Essentially, a receipt looks back at a completed transaction, while an invoice looks forward to a pending payment. While receipts and invoices are often used interchangeably, there’s a key distinction.

For example, if you visit a clothing store and finish checking out, you’ll be given the option of a paper and digital receipt or just one or the other. For thousands of years, people have been buying, selling, and jotting (or chiseling) down written receipts to prove an exchange of merchandise or money was made. This type of receipt is produced while the handwritten receipt is being written. Every receipt page in a receipt notebook has a carbon layer behind it. As a result, the vendor may trace the receipt onto the layer beneath and keep it. Types include current and noncurrent, operating and nonoperating, physical, and intangible.

Without receipts, you run the risk of the buyer, the seller, or your company being unable to show proof of payment or a business transaction that took place. If a business sells services and those payments were collected in cash, then those payments would be put toward accounts receivable. Gross profit simply describes the total value of sales in a given accounting period without adjusting for their costs.

Students sometimes enter accounting programs with little technical knowledge. This guide serves as an easy-to-use resource for developing the vocabulary used by accounting professionals. Presented in alphabetical order, this glossary of accounting terms covers essential basics and key concepts.